The Midwest is experiencing a manufacturing renaissance that’s reshaping the industrial real estate landscape across the region. From massive semiconductor fabs to cutting-edge EV battery plants, billions in new investment are flowing into markets from Ohio to Kansas, creating unprecedented opportunities for America’s industrial base. Below is a recap of JLL’s latest research piece on the Midwest Manufacturing Resurgence.

A New Era of Manufacturing Investment

The numbers tell a compelling story. According to JLL’s latest research, across the Midwest, manufacturers have announced over $149 billion in new investments. Illinois leads the region with $46.1 billion in advanced manufacturing economic output, while Ohio follows with $25 billion in manufacturing investments. This isn’t just traditional heavy industry. It’s next-generation manufacturing spanning semiconductors, electric vehicles, life sciences, and defense technology.

JLL’s analysis shows the investment surge is driven by several converging factors: nearshoring and reshoring efforts bringing production back to America, federal incentives like the CHIPS Act and Inflation Reduction Act, abundant labor availability, significant cost advantages, and the region’s unmatched central location and logistics infrastructure.

Industry Diversification Creates Regional Resilience

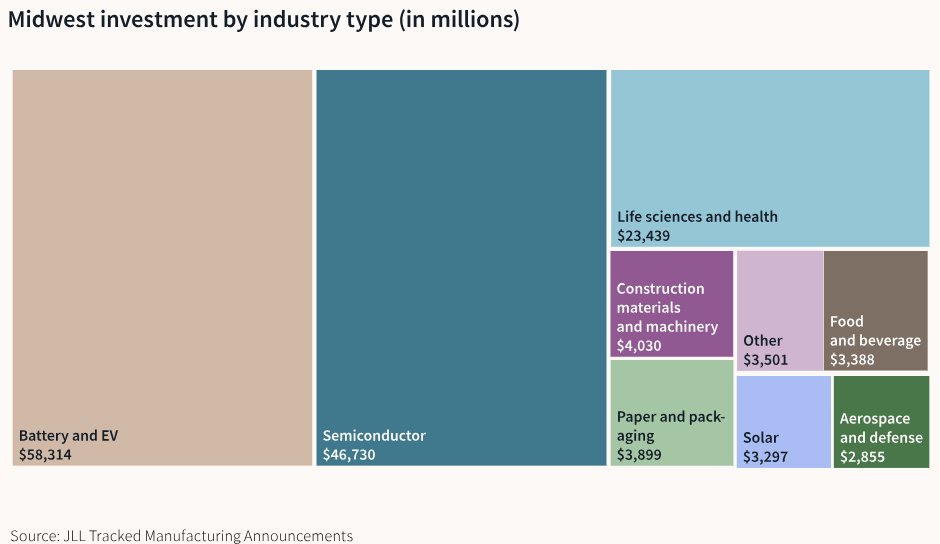

One of the Midwest’s greatest strengths is the diversity of its manufacturing base. According to JLL’s research, the region is no longer dependent on a single driver of growth. Battery and EV investments lead at $58.3 billion, followed by semiconductor investments at $46.7 billion, and life sciences and health at $23.4 billion. Construction materials, paper and packaging, food and beverage, solar, and aerospace round out the investment portfolio.

This evolving mix reflects the adaptability of the region’s industrial economy and provides stability in the face of broader market fluctuations. For industrial users, this cross-sector activity creates valuable co-location opportunities, while developers and investors benefit from a more balanced and future-ready tenant pipeline.

Market Performance: Winners and Challenges

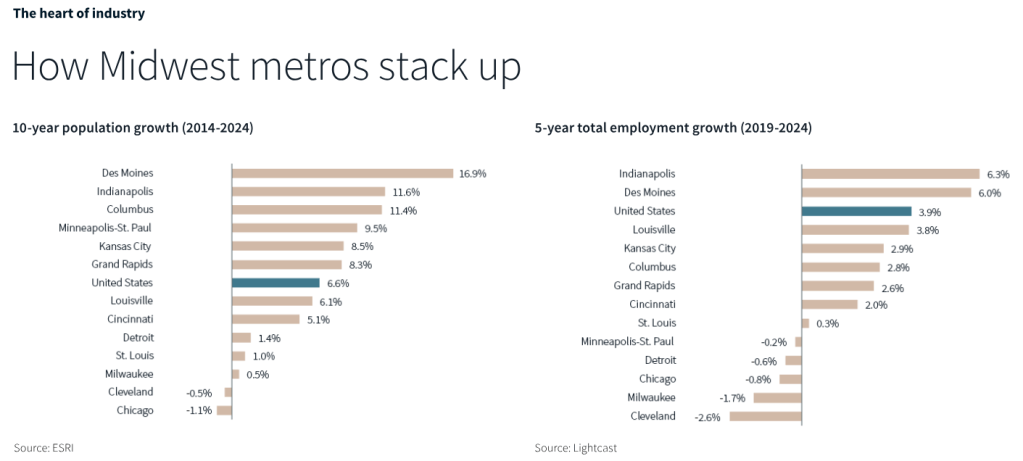

While the Midwest as a whole is experiencing growth, performance varies significantly across individual markets. JLL’s employment growth data reveals some clear standouts and underperformers. Des Moines leads the region with impressive 16.9% employment growth, followed by Indianapolis at 11.6% and Columbus at 11.4%. These markets represent rising hubs for industrial demand, drawing interest from manufacturers looking for labor access, affordability, and logistics strength.

However, not all markets are participating equally in this renaissance. Cleveland shows a slight employment decline of 0.5%, while Chicago faces more significant challenges with negative 1.1% growth. These disparities highlight the importance of market-specific strategies for industrial real estate professionals.

Cleveland’s Position

While Cleveland faces employment growth challenges compared to other Midwest markets, the city maintains strategic advantages that keep it relevant in the manufacturing conversation. Its Great Lakes location provides manufacturers access to major North American markets and global shipping routes through established transportation infrastructure. The city’s industrial heritage offers existing facilities and infrastructure that can be repurposed for modern manufacturing needs.

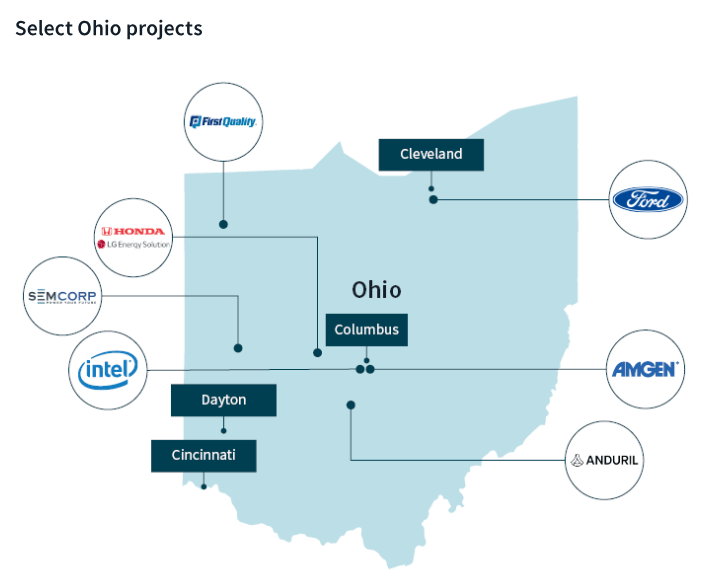

More importantly, Cleveland benefits from Ohio’s broader manufacturing momentum. Major investments like Intel’s Columbus semiconductor facility and Ford’s $1.5 billion electric commercial van commitment create supply chain opportunities that can benefit Cleveland-area industrial properties. The key for Cleveland stakeholders is positioning the market as a cost-effective alternative within Ohio’s manufacturing ecosystem rather than competing directly with faster-growing markets.

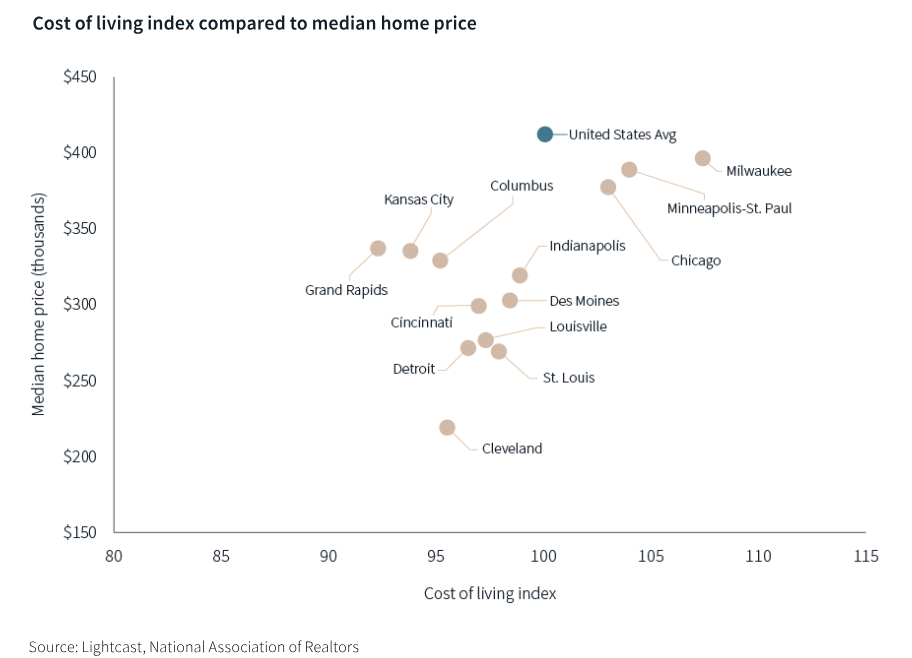

Cost Advantages Drive Location Decisions

JLL’s cost analysis reveals significant competitive advantages across Midwest markets. According to Moody’s Analytics data cited in JLL’s report, key markets like Des Moines (85.1), Kansas City (90.0), Indianapolis (90.5), and Cleveland (91.7) all fall well below the national average (100) in terms of overall cost of doing business. This index factors in labor, energy, taxes, and commercial rents, making it a powerful indicator of real operational value for manufacturers.

Cleveland’s cost advantage becomes particularly relevant when considering its 91.7 rating compared to more expensive markets like Chicago (99.2) or Minneapolis (106.1). For manufacturers seeking established infrastructure at competitive costs, Cleveland presents compelling value.

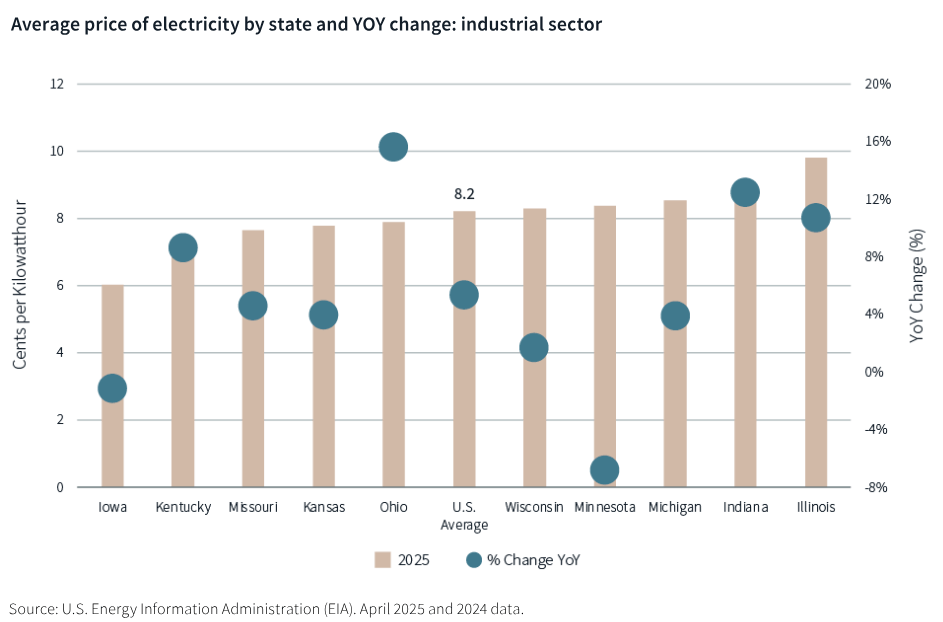

However, JLL’s research also highlights emerging challenges. Power demand is increasing across industries nationally, and some lower-cost markets are experiencing the highest electricity price increases year-over-year. Ohio is showing increases of 16%, while Indiana and Illinois trail closely behind with 13% and 11%, respectively.

The EV and Battery Revolution

The electric vehicle and battery sector represents the largest single investment category in Midwest manufacturing. JLL’s data shows $58.3 billion in battery and EV investments across the region, with major projects transforming the industrial landscape.

Notable developments include Ford and CATL’s $2.5 billion battery plant in Marshall, Michigan, spanning 2.5 million square feet, and StarPlus Energy’s massive $7.5 billion investment in two lithium-ion battery plants in Kokomo, Indiana. These facilities require specialized infrastructure including enhanced power systems, sophisticated climate control, and stringent safety features.

For industrial real estate professionals, the EV revolution creates demand for both large-scale manufacturing facilities and smaller supplier operations. The supply chain complexity of battery production means successful EV manufacturing hubs typically generate multiple smaller industrial real estate opportunities in their vicinity.

Semiconductor Manufacturing

The semiconductor sector represents another transformative force in Midwest manufacturing. Led by Intel’s massive Ohio investment, the region is positioning itself as a domestic alternative to overseas chip production. JLL tracks $46.7 billion in semiconductor investments across the Midwest, with projects ranging from Intel’s Columbus mega-site to smaller specialized facilities.

Semiconductor manufacturing demands extremely sophisticated facilities with precise environmental controls, substantial utility infrastructure, and specialized clean room capabilities. These requirements create opportunities for developers who can deliver highly technical industrial space, though the expertise barrier to entry is significant.

The semiconductor buildout also generates substantial indirect industrial demand. Each major chip facility requires numerous suppliers, logistics operations, and support services, creating a multiplier effect that benefits broader industrial markets.

Life Sciences

Life sciences and healthcare manufacturing represents $23.4 billion in Midwest investments according to JLL’s research. This sector includes everything from pharmaceutical production to medical device manufacturing and biotechnology operations.

Eli Lilly’s $9 billion LEAP project in Lebanon, Indiana, exemplifies the scale and sophistication of modern life sciences manufacturing. The 1.2 million square foot facility will integrate research, process development, and manufacturing, creating 900 new jobs while significantly reducing clinical trial timelines.

Life sciences facilities require specialized infrastructure including advanced HVAC systems, backup power, controlled access, and often specialized waste handling capabilities. For industrial developers, this sector offers opportunities for higher-value projects with long-term, stable tenants.

Infrastructure and Logistics

The Midwest’s manufacturing renaissance relies heavily on the region’s superior logistics infrastructure. JLL’s analysis highlights how the region’s central location provides access to major population centers within efficient shipping distances. Illinois alone offers access to 43% of the U.S. population within a twelve-hour truck drive.

The region’s transportation advantages extend beyond trucking. Chicago’s O’Hare International Airport ranks as the 5th most connected airport globally, moving 1.9 million metric tons of cargo annually. The convergence of all Class 1 railroads in Illinois provides unparalleled rail connectivity. Meanwhile, Kentucky’s ranking as 4th nationally in navigable waterways demonstrates the region’s multimodal transportation strengths.

For industrial real estate, proximity to these transportation nodes increasingly drives site selection decisions. Properties near major airports, rail terminals, or interstate interchanges command premium rents and experience higher demand.

Industrial Real Estate Implications

JLL’s analysis identifies distinct opportunities for industrial real estate professionals in this manufacturing boom:

For Developers: The scale of these operations demands specialized facilities with precise requirements. Think enhanced floor load capacities, higher clear heights, significant power capacity, and integrated digital infrastructure. JLL notes that creating “shovel-ready” sites with expedited permitting processes has become critical as companies prioritize speed-to-market.

Successful developers are also considering sustainability features, as many manufacturers have corporate environmental goals that extend to their facilities. Solar-ready roofs, EV charging infrastructure, and energy-efficient building systems are becoming standard expectations rather than premium features.

For Investors: JLL emphasizes that manufacturing investments represent long-term stability with significant multiplier effects. Beyond primary facilities, investors should consider the ecosystem forming around major manufacturing hubs, including supplier networks, logistics facilities, and workforce housing.

The geographic concentration of investments also creates opportunities for portfolio strategies. Investors who can assemble multiple properties within emerging manufacturing corridors may benefit from increased tenant demand and rental growth.

For Property Owners: According to JLL’s research, existing industrial property owners in manufacturing corridors have new opportunities to reposition aging assets to support next-generation manufacturing or its supply chain. Properties with strategic locations near transportation hubs or with access to robust utility infrastructure will command premium values.

Property owners should also consider the retrofit potential of existing buildings. Many modern manufacturing operations can adapt older industrial buildings with proper utility upgrades and interior modifications.

Challenges and Risks

While the Midwest manufacturing renaissance creates substantial opportunities, JLL’s research also identifies potential challenges. Rising electricity costs, particularly Ohio’s 16% increase, pressure operating margins for energy-intensive manufacturers. Competition for skilled workers is intensifying wages and potentially constraining growth.

Supply chain complexity also creates risks. The interconnected nature of modern manufacturing means disruptions at major facilities can impact entire regional ecosystems. Industrial real estate professionals need to understand these dependencies when evaluating investment opportunities.

Environmental considerations are becoming more stringent. New manufacturing facilities face increasingly complex permitting processes, and existing facilities may require significant upgrades to meet modern environmental standards.

The Future of Midwest Manufacturing

As JLL’s research demonstrates, the Midwest manufacturing sector is evolving from traditional production to high-tech, specialized manufacturing. This transformation represents not just a resurgence, but a redefinition of what modern manufacturing looks like. The Midwest is uniquely positioned to capitalize on this shift.

The region’s success will depend on continued infrastructure investment, workforce development, and maintaining cost competitiveness. Policy makers and economic development organizations play crucial roles in sustaining momentum through supportive regulatory environments and targeted incentives.

For industrial real estate professionals, the most successful will be those who position themselves not just as space providers but as strategic partners in the manufacturing ecosystem. Understanding the technical requirements, supply chain relationships, and long-term growth trajectories of different manufacturing sectors will be essential for success.

The data clearly shows the Midwest is reclaiming its role at the forefront of American industry. This manufacturing renaissance creates a multi-year opportunity for industrial real estate professionals who can adapt their strategies to serve the evolving needs of advanced manufacturing. The region’s combination of cost advantages, infrastructure assets, and skilled workforce provides a solid foundation for sustained growth in industrial real estate demand.

This analysis is based on JLL’s comprehensive research report “How the Midwest is powering America’s manufacturing future 2025: The heart of industry.” For detailed market data and additional insights, contact your local JLL industrial team.

Sources: JLL Research, Jones Lang LaSalle IP, Inc., US Energy Information Administration, Moody’s Analytics, ESRI

Leave a comment