Cleveland’s industrial real estate market demonstrated some resilience in the third quarter of 2025, with fundamentals stabilizing following the significant occupancy loss experienced in Q2 and showing encouraging signs of recovery across multiple metrics.

Here are the key takeaways from JLL’s latest market reports for both Cleveland and the broader U.S. industrial market, along with analysis of emerging trends shaping the sector.

Q3 Cleveland Market Performance

Positive Absorption Recovery: Cleveland recorded 156,831 square feet of positive net absorption in Q3, marking a strong recovery from the previous quarter’s challenges. While year-to-date absorption remains at -981,327 square feet, this figure continues to reflect the impact of Joann Fabrics’ 1.4 million square foot closure in Summit County during Q2.

Sustained Rent Growth: Average asking rents climbed to $5.68 per square foot in Q3, continuing the upward trajectory established earlier in the year. Class A properties led rent growth with a robust 7.1% year-over-year increase, while Class B and C segments also experienced upward pricing pressure due to ongoing competition for available space.

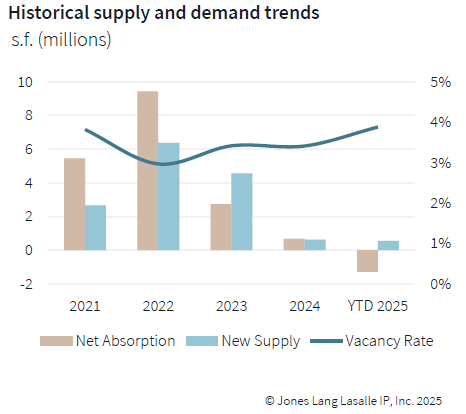

Persistently Tight Market Conditions: The overall vacancy rate held steady at 3.8% in Q3, reflecting continued tight supply conditions with limited availability for occupiers seeking industrial space. Total availability stands at 6.1%, indicating that Cleveland maintains one of the tightest industrial markets in the region.

Strong Leasing Momentum: Year-to-date leasing volume reached 87.6% of 2024 levels on a square footage basis, demonstrating that underlying demand remains robust despite economic uncertainty. Q3 saw numerous leases signed in recently developed speculative product, highlighting occupiers’ continued commitment to the Cleveland market.

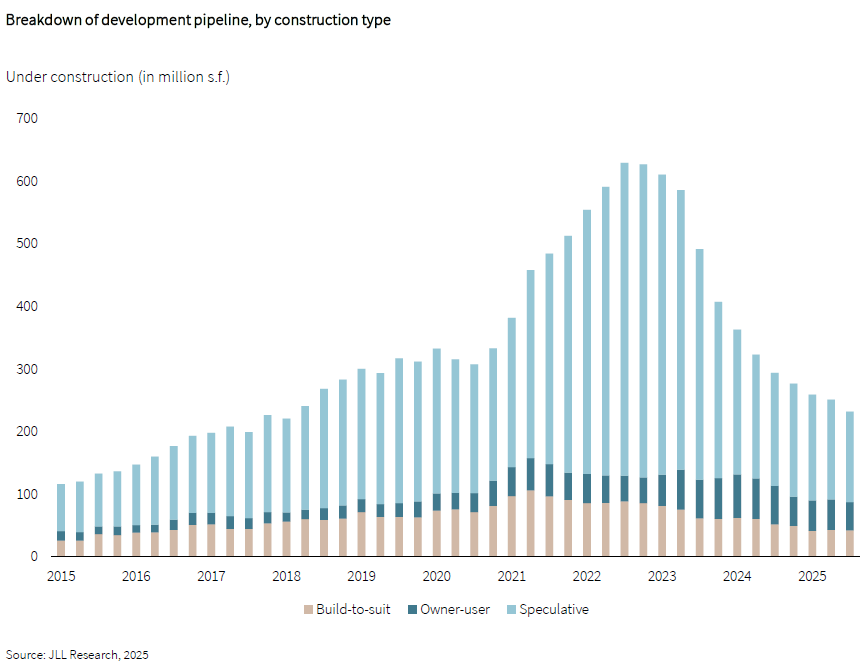

Limited Development Pipeline: Construction activity remains constrained with 515,211 square feet under development and 51.4% preleased. This measured approach to new supply continues to support pricing power for existing inventory.

National Industrial Market Context

The U.S. industrial sector showed broad-based improvement in Q3 2025, with several key trends that align with Cleveland’s market dynamics:

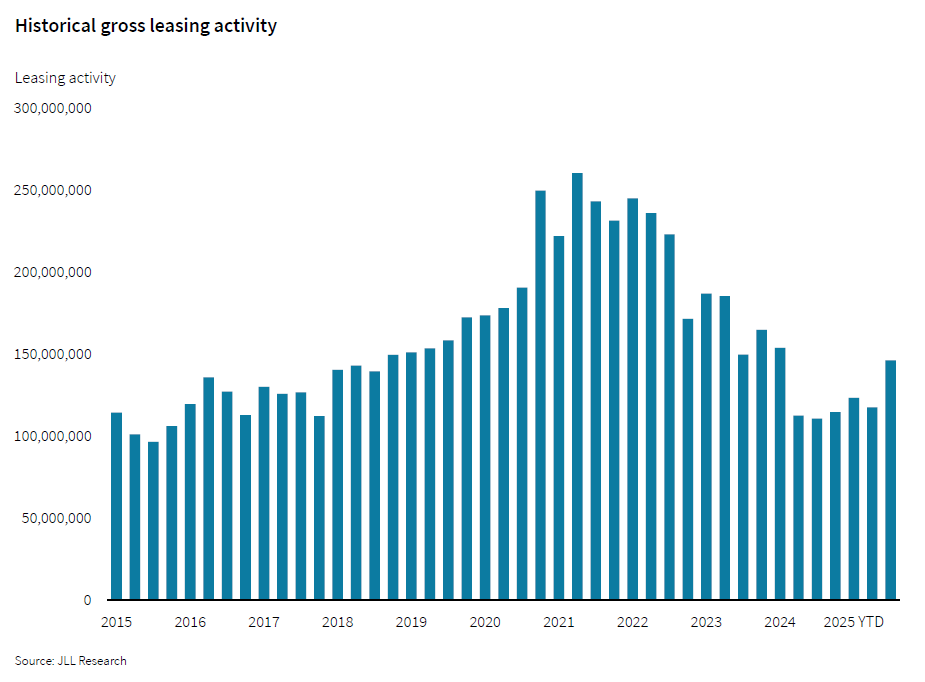

Nationwide Leasing Recovery: Industrial leasing activity surged 32.3% year-over-year to 146.2 million square feet, marking the best quarter of leasing since Q1 2024. This improvement reflects growing tenant confidence and continued demand for warehouse and distribution space across the country.

3PL Dominance: Third-party logistics users maintained their position as the top industry, representing 19.2% of all Q3 leasing activity. This trend underscores companies’ strategic shift toward outsourced logistics solutions to maintain operational flexibility amid trade policy uncertainties. Cleveland remains a manufacturing-focused market compared to other markets with heavy 3PL & logistic/distribution end-users.

National Absorption Rebound: Net absorption doubled from the previous quarter to 38.2 million square feet, bringing year-to-date totals to 101 million square feet. Twenty markets achieved at least 1 million square feet of positive absorption, with much of the growth driven by owner-user sales and build-to-suit project occupancies.

Manufacturing Renaissance: Manufacturing leasing recorded its third consecutive quarter of growth with a dramatic 330.1% year-over-year increase, driven by expanding supplier networks prioritizing domestic manufacturing capacity. This nearshoring trend particularly benefits markets like Cleveland with established manufacturing infrastructure.

Capital Markets and Investment Activity

Transaction Volume Growth: U.S. industrial transaction volumes totaled $67.3 billion year-to-date, reflecting 16% growth above last year’s pace despite ongoing trade policy uncertainty.

Improved Debt Markets: Debt liquidity has become exceptionally robust, with JLL tracking nearly 233 lenders quoting industrial loans in Q3 2025, representing a 52% increase from the market trough in Q4 2023.

Market Outlook

Cleveland’s industrial market positioning aligns favorably with several national trends that should support continued growth:

Supply Constraint Benefits: With development pipelines remaining constrained both locally and nationally, Cleveland’s tight vacancy conditions should persist, supporting continued rent growth and landlord pricing power.

Manufacturing Advantage: As companies continue nearshoring operations, Cleveland’s established manufacturing base and transportation infrastructure position it well to capture this demand.

Infrastructure Investments: National infrastructure investments are beginning to pay dividends, with improved transportation networks and enhanced utility capacity addressing previous growth bottlenecks. Cleveland’s ongoing infrastructure improvements should help maintain its competitive position.

Regional Competitiveness: While Sunbelt markets continue to capture significant industrial investment, Midwest markets like Cleveland offer competitive advantages including established labor markets, existing manufacturing expertise, and lower operating costs.

Summary

Cleveland’s Q3 performance demonstrates the market’s underlying strength, with positive absorption returning and fundamentals remaining tight across all asset classes. The recovery from Q2’s significant move-out event, combined with sustained leasing activity and continued rent growth, reinforces Cleveland’s position as a stable industrial market.

Looking ahead, limited supply additions, strong manufacturing trends, and Cleveland’s strategic location should continue supporting positive market dynamics through the remainder of 2025 and into 2026.

Sources: JLL Research, Jones Lang LaSalle IP, Inc., Q3 2025 Industrial Market Dynamics Reports

Leave a comment