Cleveland’s industrial real estate market experienced mixed dynamics in the second quarter of 2025, with strong fundamentals partially offset by a significant move-out event that impacted overall absorption figures.

Here are the key takeaways from JLL’s latest market report, along with additional context on the U.S. industrial market and recent developments.

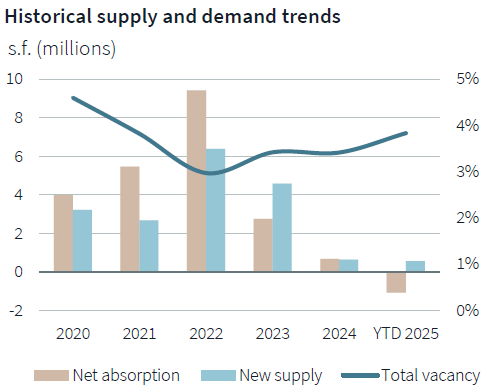

Q2 Trends and Data

Negative Absorption with Context: Cleveland recorded -1.09 million square feet of net absorption in Q2, though this was largely due to Joann Fabric’s bankruptcy and subsequent vacation of 1.4 million square feet in Summit County. When we factor out this anomalous vacancy, Cleveland’s industrial sector would actually demonstrate positive territory with roughly 270,000 square feet absorbed since January, indicating underlying stability.

Continued Rent Growth: Direct rents increased to $5.61 per square foot, with secondary and tertiary industrial properties seeing significant rental increases, with rates climbing 6% just within the most recent quarter. This upward pressure on rents stems from limited availability across the market.

Class A Performance: Premium Class A facilities have shown remarkable strength, reducing their availability rate by 2.5 percentage points compared to last year. These top-tier properties have attracted substantial tenant interest, gaining approximately 3.6 million square feet in occupied space over this period, demonstrating strong tenant demand for premium space.

Limited Development Pipeline: Only 515,211 square feet remains under construction, with 38.8% already preleased. This represents a decrease in development activity compared to previous quarters.

Steady Vacancy: Despite the Joann Fabric move-out, total vacancy increased only moderately to 3.8%, while total availability stands at 6.0%. These figures remain healthy compared to national averages.

Notable Lease Activity: The most significant leasing transaction of 2025 to date occurred when Piping Rock secured approximately 409,000 square feet at the Turnpike Commerce Center development in Shalersville, highlighting continued demand for newly developed Class A space.

U.S. Industrial Market Context

The U.S. industrial real estate market continues to show resilience in 2025, though regional variations are becoming more pronounced. Key national trends include:

Flight to Quality: Tenants increasingly favor modern facilities that can accommodate advanced logistics and manufacturing operations, similar to the Class A absorption strength seen in Cleveland.

Rent Growth Acceleration: Limited availability of quality space has pushed rents higher across many markets, with some regions experiencing even steeper increases than Cleveland’s notable 6% quarterly growth in Class B and C spaces.

Selective Development: Nationwide, developers have become more cautious, focusing primarily on pre-leased projects or those in supply-constrained submarkets. This trend is reflected in Cleveland’s modest construction pipeline of just over 500,000 square feet.

Large Block Scarcity: The shortage of available large contiguous spaces (100,000+ square feet) is a nationwide phenomenon that’s particularly acute in Cleveland, driving renewal activity as tenants face limited relocation options.

Market Outlook

Looking ahead, Cleveland’s industrial market is expected to maintain positive momentum despite the Q2 absorption setback. The vacancy increase appears to be a one-time event rather than the beginning of a trend, with fundamentals remaining strong across all asset classes.

Several factors support an optimistic outlook:

Tight Market Conditions: With space options constrained across all property categories, landlords will likely maintain pricing power, pushing rental rates higher throughout the remainder of the year.

Renewal Activity: Given the scarcity of large block availabilities, tenants facing lease expirations may have little choice but to renew, supporting occupancy levels.

Strategic Location: Cleveland’s position in the manufacturing heartland and access to transportation infrastructure continues to make it attractive for industrial users, particularly those focused on regional distribution. Across various brokerage firms, there has been an increase from international companies looking for manufacturing space across Northeast Ohio.

Balanced Pipeline: While the construction pipeline is modest at 515,211 square feet, this measured approach to new development should help maintain market equilibrium and support continued rent growth.

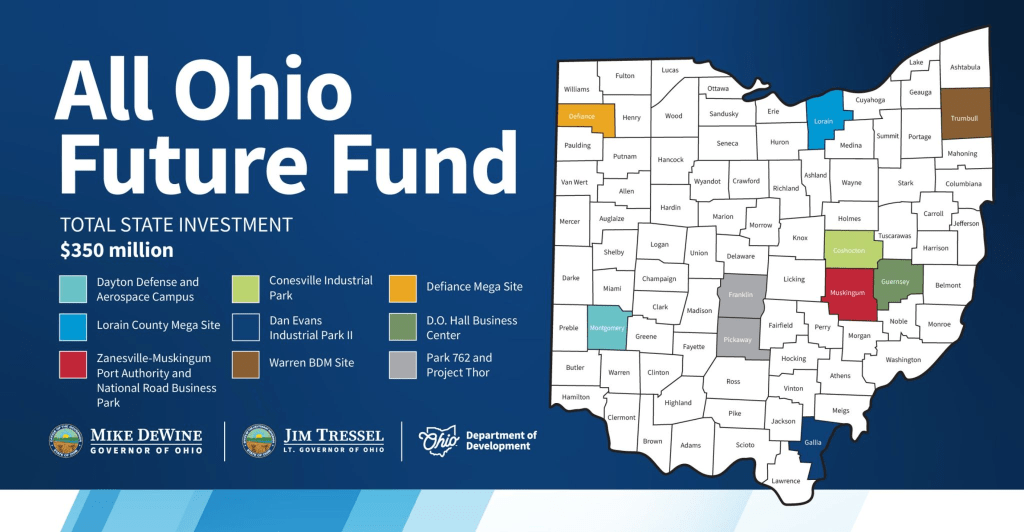

The recent Northeast Ohio Megasite announcement:

A significant industrial development initiative is underway with the 1,000-acre Northeast Ohio Megasite in New Russia Township. The project recently received crucial backing with $67 million in state funding dedicated to establishing essential water and sewer infrastructure. This development addresses Northeast Ohio’s historical shortage of large-scale, ready-to-develop industrial properties that have previously attracted major manufacturers to other regions of the state.

The site is strategically located near the Lorain County Regional Airport and offers numerous advantages, including proximity to population centers, existing utilities access, and strong transportation connections. With development timelines projecting tenant operations within 3-5 years, the project represents a coordinated effort between county officials, Team NEO, and state representatives to create a truly “shovel-ready” industrial opportunity that could transform the region’s economic landscape.

Summary:

Despite the significant move-out event in Q2, Cleveland’s industrial market fundamentals remain strong, with positive indicators across various metrics suggesting continued stability and growth through the remainder of 2025.

Sources: JLL Research, Jones Lang LaSalle IP, Inc., Crain’s Cleveland

Leave a comment