As 2025 progresses, the industrial real estate market in Cleveland and across the country is poised for continued growth. Manufacturing is expanding in the U.S. at a clip not seen for decades. Additionally, demand remains steady for logistics & distribution space, along with R&D and flex space.

As the industrial sector navigates through broader economic and technological shifts, it continues to demonstrate resilience and adaptability, positioning Cleveland as a key player in the ongoing industrial renaissance.

Manufacturing Renaissance

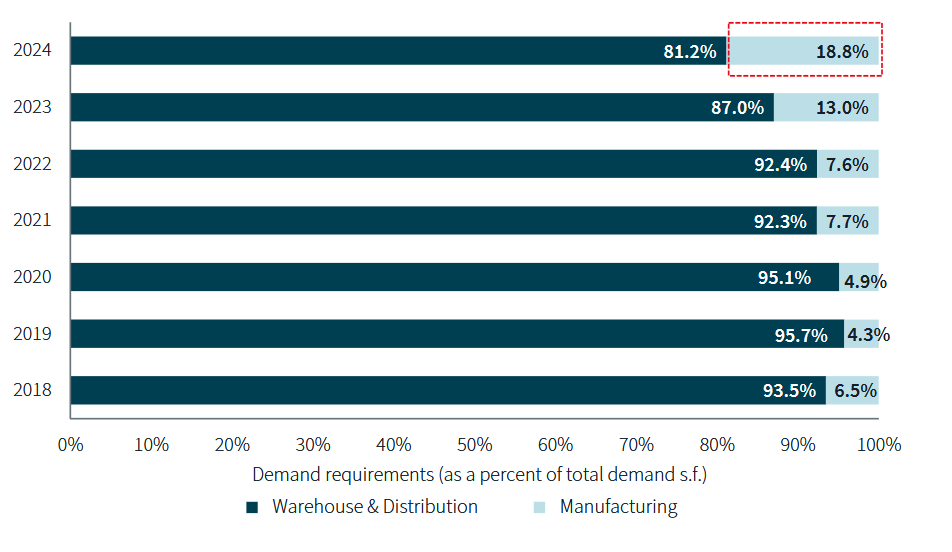

According to JLL, manufacturing demand requirements across the entire US market reached 18.8% in 2024, up from 13% in 2023 and 7.6% in 2022. From 2018 – 2020, manufacturing requirements averaged 1.9% per year. What’s causing the dramatic increase in manufacturing requirements? Electric vehicles, batteries, semi conductors, aerospace & defense, and AI.

In Cleveland, Ford is expanding their existing production facility in Lorain County by investing $1.5B into their Ohio Assembly Plant, which will produce a wide range of electric vehicles.

In Central Ohio, outside of Columbus, plans were announced earlier this year that Anduril, a leader in autonomous systems and weapons manufacturing, will build a 5M square foot hyperscale manufacturing facility, called Arsenal-1. Similarly, outside of Columbus, Intel is building two semiconductor chip factories in New Albany, investing a total of $28 billion in the region.

As the AI arms race continues to heat up, demand for data centers is growing exponentially. Central Ohio has been a major beneficiary of this activity in the last 10 years, with all of the major hyper-scalers (Meta, AWS, Google, Microsoft) investing billions into the region. Based on local insight from brokers in that market, power is all tapped out, and there is an increase in the likelihood of data center development reaching Northern Ohio as the local utility companies still have excess power available.

US Policy & the CRE Market

In 2025, US policy will play a large role in the performance of the industrial real estate market. Taxes, spending, interest rates, foreign policy and regulations will all play a role in how the sector performs under the Trump administration.

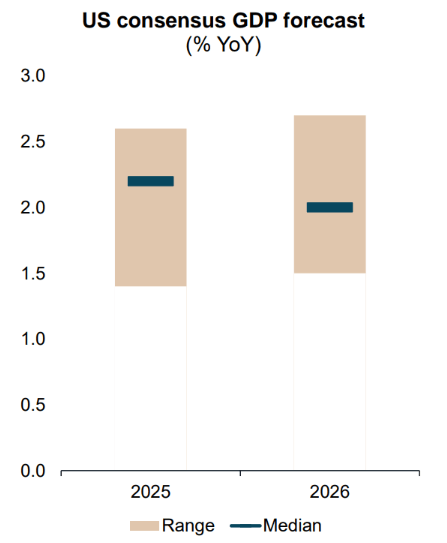

The Tax Cuts and Jobs Act passed in 2017 will revert back to prior levels unless new legislation is passed by Congress this year. 1031 exchanges and certain deductions could be impacted if Congress doesn’t renew this policy. Renewal of tax cut legislation, in addition to deregulation and an overall increase in business confidence, could lead to an increase in GDP growth in 2025.

A major theme of the Trump administration is deregulation, which could have positive impacts on commercial real estate if credit, capital formation and operation costs are less burdensome. As we’ve seen over the last few weeks, tariffs are at the forefront of the new administrations strategy to combat ballooning trade deficits. Manufacturers are electing to sure-up supply chains and minimize the potential impact of tariffs by investing in new manufacturing and distribution facilities in the US.

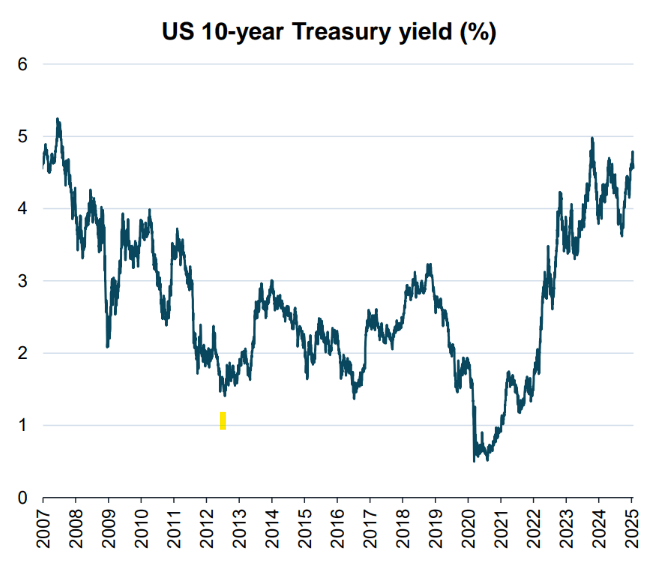

Lastly, federal spending and interest rates will impact commercial real estate values and the ability for companies to invest in new projects. There are expectations for the Federal Reserve to keep interest rates steady to combat continued inflation concerns, which affects borrowing costs. If borrowing costs remain elevated relative to previous years, companies may have to delay the development of new facilities to keep profitability levels consistent with expectations.

What to expect in the Cleveland Market in 2025

Cleveland continues to be one of the steadiest industrial real estate markets in the US. Vacancy rates ended 2024 at roughly 3.3% according to JLL, and the consensus is a vacancy rate between 3% – 4% to remain in 2025.

Lease rates continue to increase each quarter, reaching $5.64/SF in Q4 2024. As new supply is constrained and the demand for space remains strong from tenants, expect a continued steady increase in lease rates in the coming year.

In 2024, almost all new construction was in the form of build-to-suit projects, meaning the vacancy rate was largely unaffected. There are only a few speculative industrial developments currently under construction, and leasing of Class A facilities remains steady, which could lead to additional speculative development in 2025 and beyond.

I expect a continuation of 2024 trends into 2025, such as strong demand for flex space from contractors and SMBs, an increase in demand for manufacturing space, and the continued strength of Class B and C space.

Specifically, in certain pockets of Cleveland, there is no new industrial space being built, while older facilities are actively being torn down to make way for multifamily developments (https://neo-trans.blog/2024/12/06/gordon-square-development-wins-approval/). Although not a large percentage of the total market square footage, it’s indicative of a more important trend – as industrial properties continue to age and are sometimes demolished for new developments, new product will need to be built to meet the demand in the market.

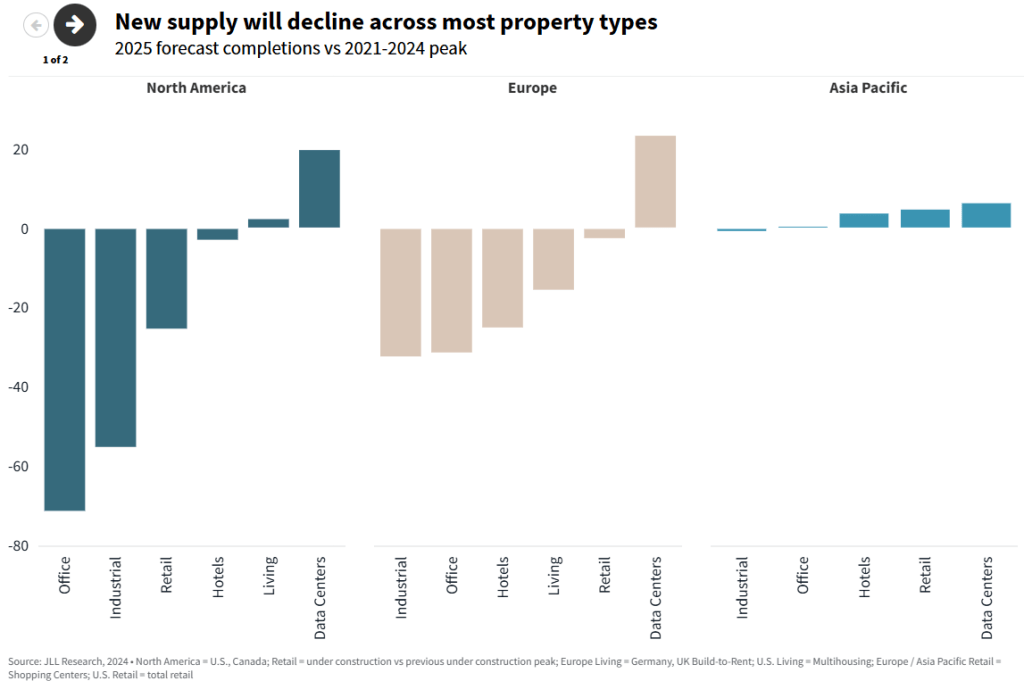

As shown above, across North America, forecasts call for a decline in new supply of industrial properties, a trend that I also am seeing across the Northeast Ohio industrial market.

The owner-user market remains very strong across the Greater Cleveland market, and I’m seeing an uptick in interest from investors for sale-leaseback and investment sale properties. I expect the owner-user market in Cleveland to remain strong in 2025, as the majority of these properties are less than 50,000 square feet, and vacancy remains low in this asset type. In certain suburbs of Cleveland, owner-user property values are consistently reaching upwards of $100 per square foot.

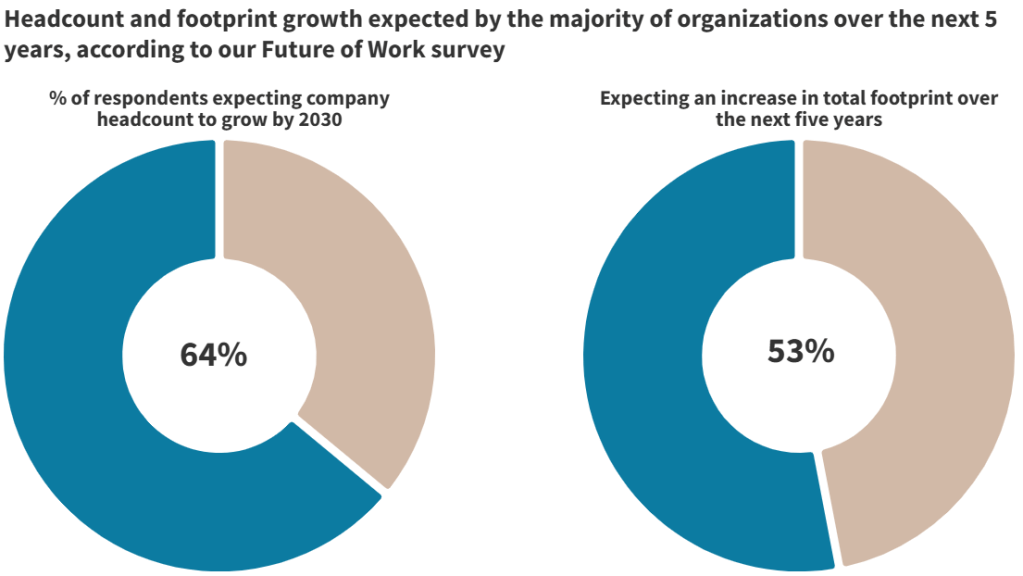

According to a recent survey completed by JLL, 64% of companies expect headcount growth by 2030, in addition to 53% of companies saying their real estate footprint will increase in the next 5 years. The survey wasn’t specific to the Cleveland market, but I would expect a similar trend among Cleveland-based companies.

Summary

As we progress through 2025, the industrial real estate market in Cleveland and across the United States demonstrates continued strength and growth. Driven by advancements in sectors like electric vehicles, semiconductors and AI, manufacturing demand is surging, evidenced by major investments across Ohio.

The Cleveland market remains particularly robust, with low vacancy rates, rising lease rates, and a thriving owner-user market. However, the landscape is evolving, with older industrial facilities in some areas giving way to multifamily developments, highlighting the need for new industrial product.

Looking ahead, companies anticipate growth in both workforce and real estate footprint, despite challenges such as potential tax policy changes and interest rate concerns. While new industrial supply is forecasted to decline across North America, including Northeast Ohio, Cleveland’s market fundamentals remain strong.

I’m excited to see what transpires during 2025.

Sources: Bureau of Labor Statistics, JLL Research, Newmark, Federal Reserve, Commercial Property Executive

Leave a comment