Overview

Cleveland’s industrial real estate market remained steady through the end of the summer. A few brokerage firms reported negative net absorption rates in Q3 for the first time in several quarters. In general, lease rates continued to increase slightly, but leasing activity began to slow down in the quarter.

Net Absorption and Vacancy Rates

In the third quarter of 2024, recorded net absorption figures published by several firms showed a slowdown in leasing activity and in some cases, negative net absorption.

Newmark reported 168K SF of negative net absorption, CBRE reported negative net absorption of 100K SF, and Colliers reported roughly 200K square feet of positive net absorption.

The vacancy rate remained steady at roughly 3% regionally, according to both CBRE (2.7%) and Colliers (3.1%). JLL reported a slightly higher vacancy rate of 3.2% for the quarter, down slightly from Q2. Newmark reported a 4.1% vacancy rate, which was a 10 basis point increase from Q2. Compared to the long term average historical vacancy rate of 8%, Cleveland’s industrial leasing market continues to perform well.

Leasing Activity

Leasing activity ticked up quarter-over-quarter across Cleveland and Northeast Ohio. According to Newmark, leasing activity totaled roughly 1.7M square feet in Q3, a sizable increase from Q2’s figure of 880K SF. JLL reported an uptick in leasing in Q3, specifically within Class A facilities across the region.

Lease Rates

In Cleveland, CBRE reported that the average asking lease rates for all subsegments of industrial real estate (warehouse, flex and manufacturing) increased slightly in the quarter to $5.68/SF. According to Colliers, lease rates for Warehouse, Flex and Manufacturing properties were $5.31/SF, $7.91/SF, and $5.62/SF, respectively.

Average asking lease rates across all industrial property types averaged $5.61/SF in Q3 2024, according to JLL, which is a slight increase from Q2 2024. Newmark reported an average asking lease rate of $6.15/SF for the quarter, which is slightly lower than Q2.

Construction Pipeline

There is currently 2.3M SF of industrial space currently under construction across Northeast Ohio, according to Colliers, a 100K SF increase vs Q2. CBRE reports the market still has ~1.2M SF of industrial product still under construction.

Lee & Associates reported 2.05M SF of industrial space is currently under construction, while Newmark reported roughly 1.5M SF of industrial product is currently under construction, which makes up just 0.5% of the overall inventory.

Political and economic uncertainty surrounding the presidential election and fears of a recession are forcing investors and developers to pull back on new ground-up developments. However, preleasing for new projects remains strong, so when these buildings are brought to market, there will be little impact on vacancy rates locally.

Notable Transactions and News

There were several notable transactions and news stories that occurred in Q3 2024:

- Industrial Commercial Properties (ICP) purchased the former Ohio Station Outlets site in Lodi, directly accessible off I-71 and Route 83. ICP plans to redevelop the site into a multi-tenant, light industrial business park, with a total of over ~330K SF available for lease.

- Nordson Corporation, a publicly traded manufacturer of industrial adhesives, sealants and coatings, will lay off more than 100 manufacturing workers at its Amherst, OH operations facilities. These roles will be moved to Nordson’s facility in South Carolina.

- B’laster Products leased 308K SF of industrial space at Westfield Commerce Center in Westfield Township at an undisclosed rate. David Stecker of JLL represented the landlord Stonemont in the transaction.

- Polestar Technologies, Inc purchased a 458K SF warehouse in Glenwillow (former TTI Floorcare property) for $28.6 million (~$62/SF), one of the largest transactions in the quarter.

- Premier Development Partners purchased the 456K SF former Bendix Commercial Vehicle Systems HQ in Elyria (901 Cleveland Street) for $6.1M ($13.36/SF) in Q3. Bendix built a brand-new HQ in Avon last year.

Economic Commentary

The S&P 500 Index is reaching all time highs and is up more than 20% YTD. However, there is a strong sense of uncertainty in the economy.

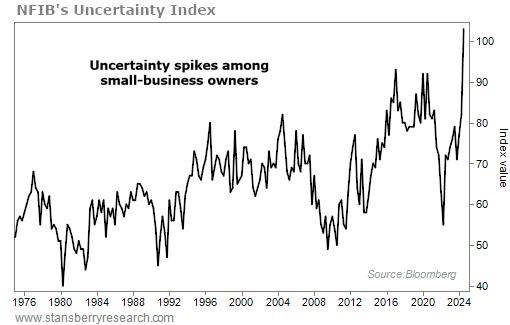

Small business owners are worried about the state of the economy, as are many investors and developers. A lot of the uncertainty is due to the upcoming presidential election, so the NFIB index will likely decrease after November 4th.

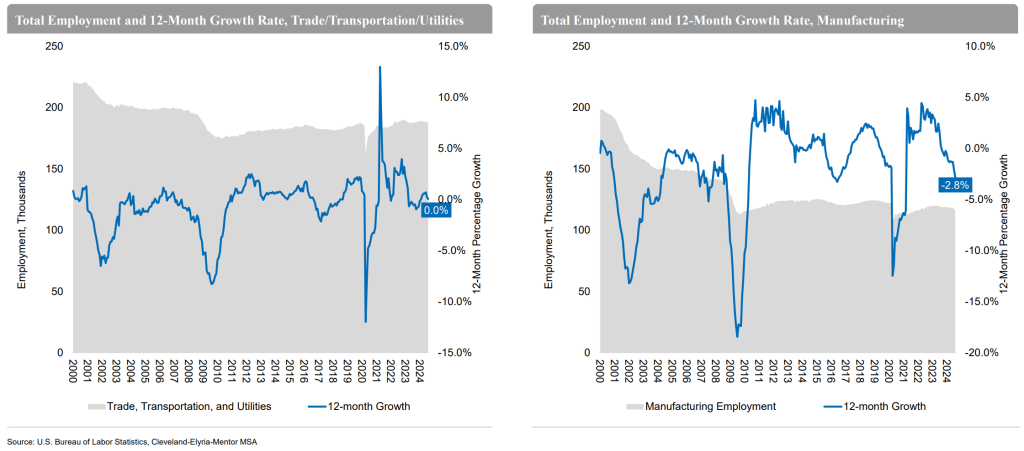

The US unemployment rate across the Greater Cleveland metropolitan was 4.1% in August after hovering around 3.8% earlier in the year. Cleveland’s Manufacturing sector saw a 2.8% YoY decline in employment. Cleveland’s Construction sector saw a 0.6% YoY decline in employment during the third quarter. Year over year growth in the Trade, Transportation and Utilities sector was 0.0%. Across the region, the Education & Health sector experienced the highest YoY employment growth, reaching 3.5%.

Outlook

Cleveland’s industrial real estate market should finish 2024 in a steady place. Vacancy rates, rent growth and absorption rates continue to show that the market is chugging along, albeit at a slower pace than prior years.

Sublease space is at its lowest point in several years, which is a positive sign for the local industrial real estate market. With new construction projects pre-leasing at a solid clip, expect vacancy to remain steady.

There is still optimism given the Fed’s recent rate cuts and expectations for several more next year, which would likely have a positive impact on transaction volume in commercial real estate.

Sources: Newmark, Lee & Associates, JLL, Colliers, CBRE, CNBC, US Bureau of Labor Statistics, Stansberry Research

Leave a comment