Newmark published their Q2 2024 U.S. Industrial Market Report a few days ago, and I wanted to highlight some data points, charts and commentary that I found interesting.

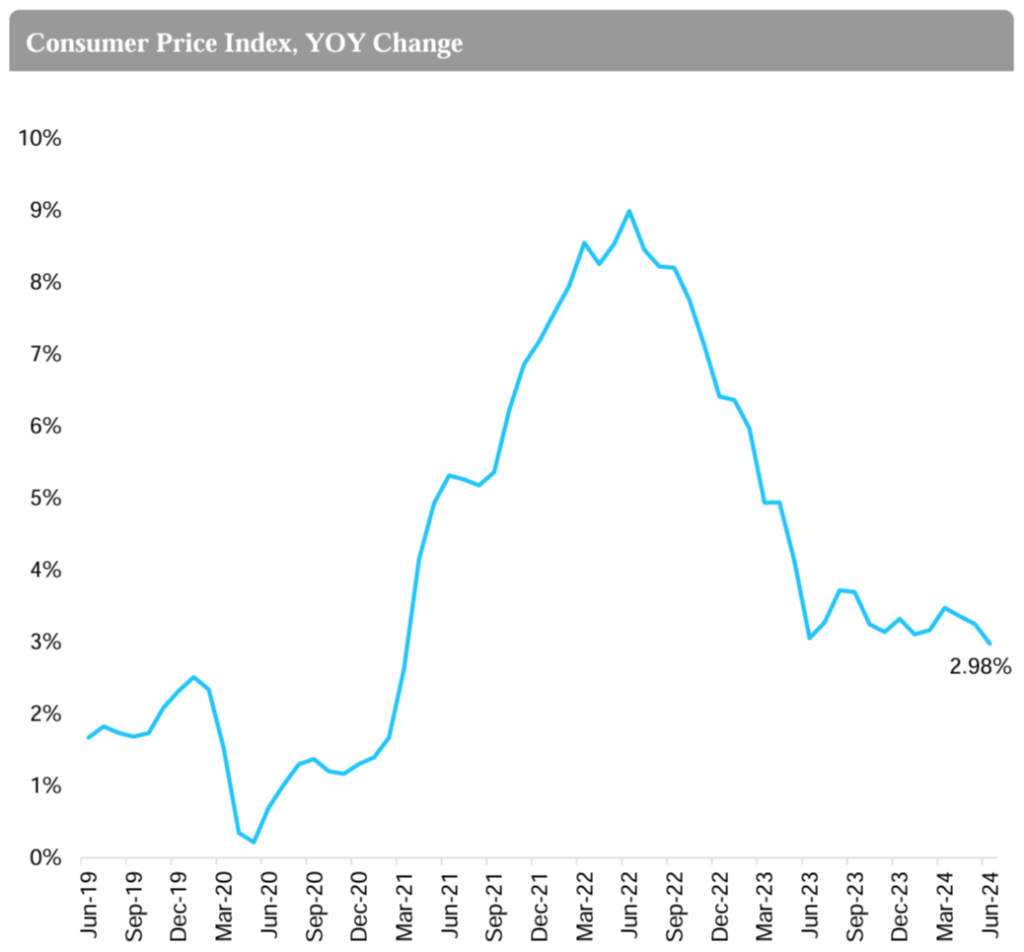

Inflation

Inflation has leveled off in recent months. It’s still above the Federal Reserve’s 2% target, but odds markets are are showing a high probability of a rate cut as the Fed’s September meeting. On Friday, August 23, Jerome Powel, Chairman of the Federal Reserve, said “the time has come for policy to adjust” at the Fed’s annual meeting in Jackson Hole, Wyoming.

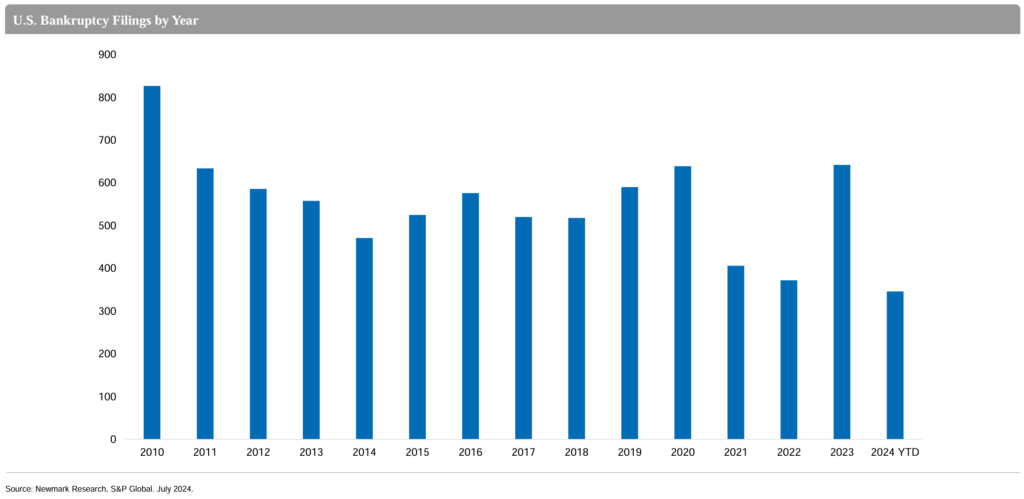

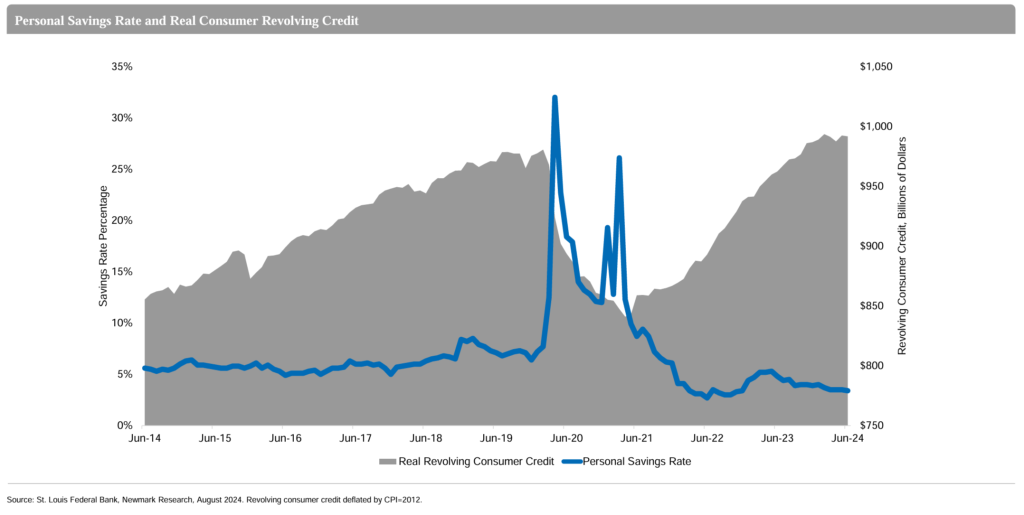

Economic Signals

There have been 346 bankruptcy filings in the US so far this year, which is the most in 13 years.

Personal savings have decreased and leveled off since the pandemic, while credit use has increased to near decade highs.

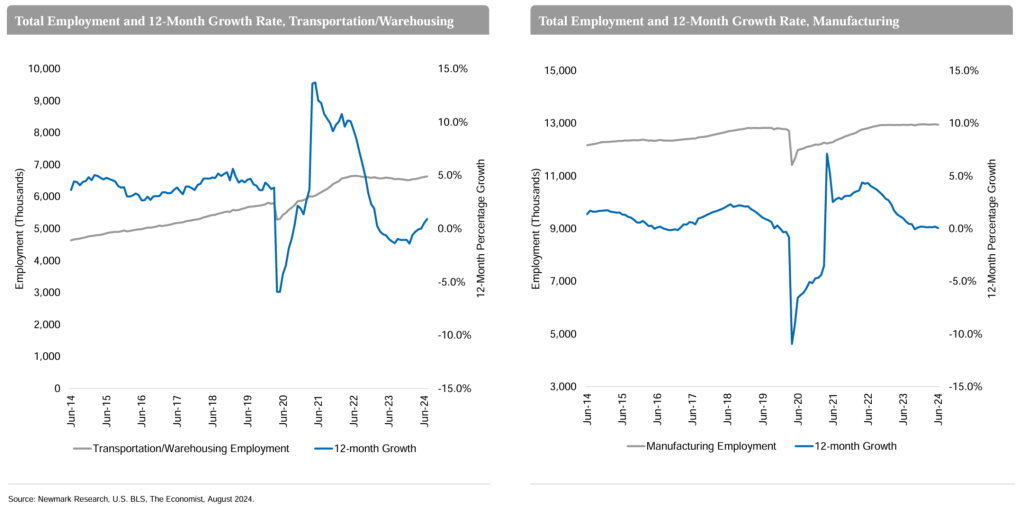

Employment

Manufacturing and transportation/warehousing employment is growing slightly in 2024, a slow down from previous years which was driven by the natural recovering of the economy following pandemic related lockdowns.

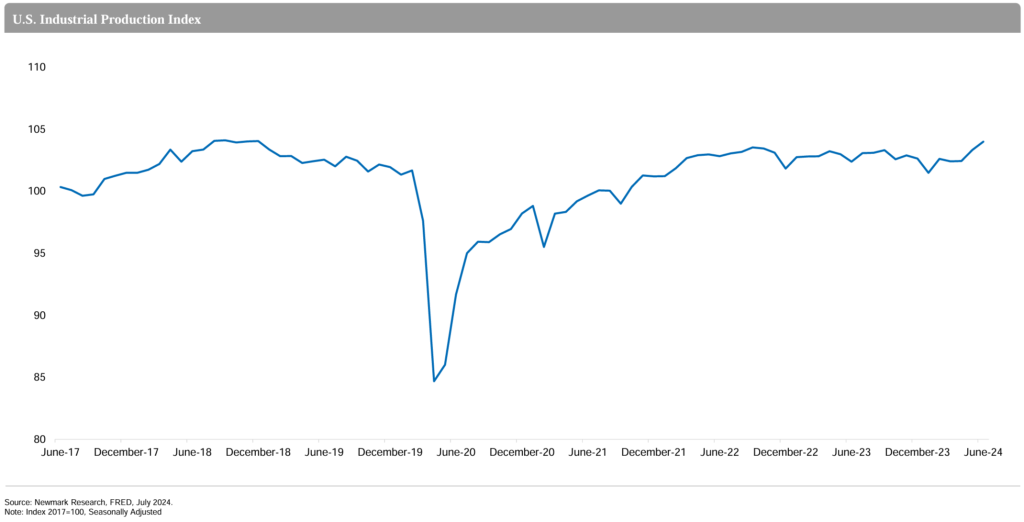

US industrial production increased 1.6% YoY in June.

Industrial Trends

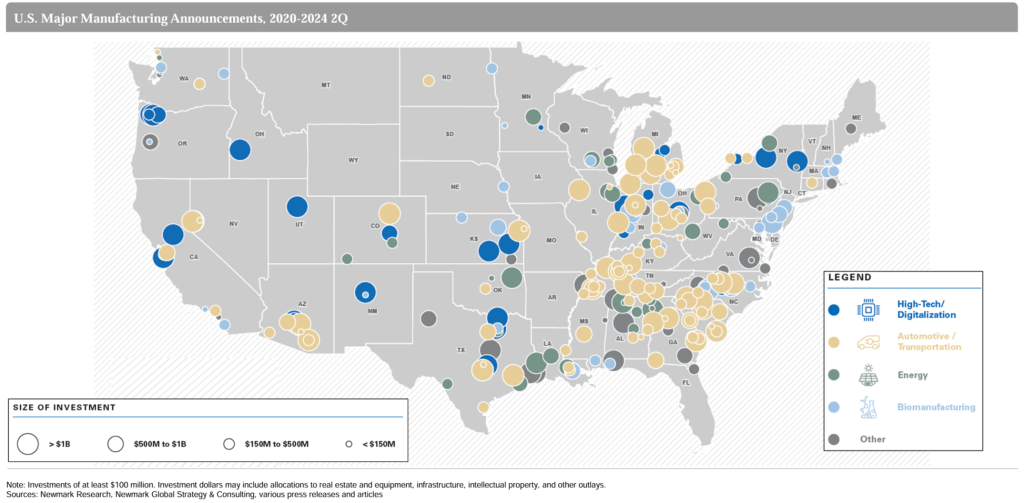

The above chart shows existing industrial real estate investments greater than $100M taking place across the US since 2020. Since 2020, over $530B of capital has been pledged across these projects. Between now and 2030, it is estimated that 270,000+ jobs will be created from these projects, with more than 270M square feet of industrial real estate built.

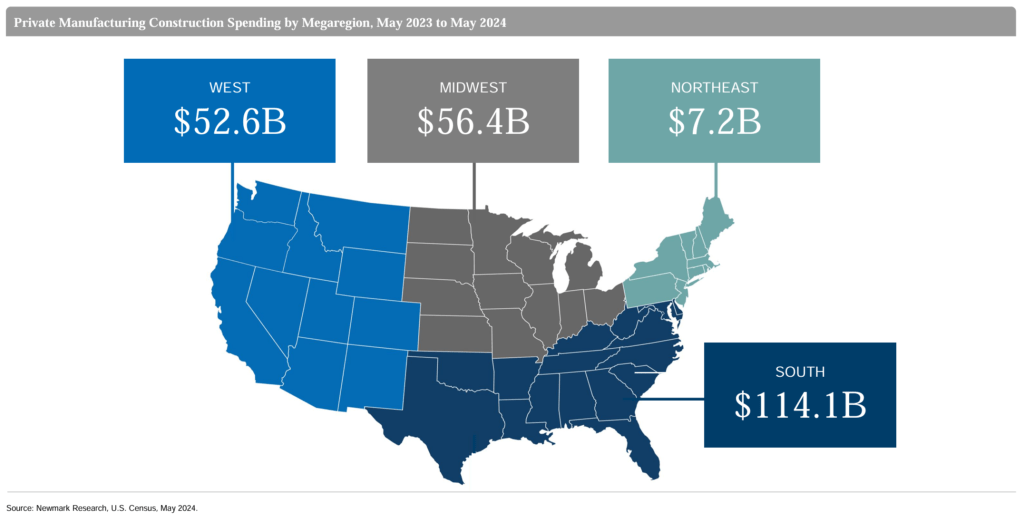

There is significant construction spending across the US. The Midwest totaled over $56.4B in construction spending, slightly behind the West region.

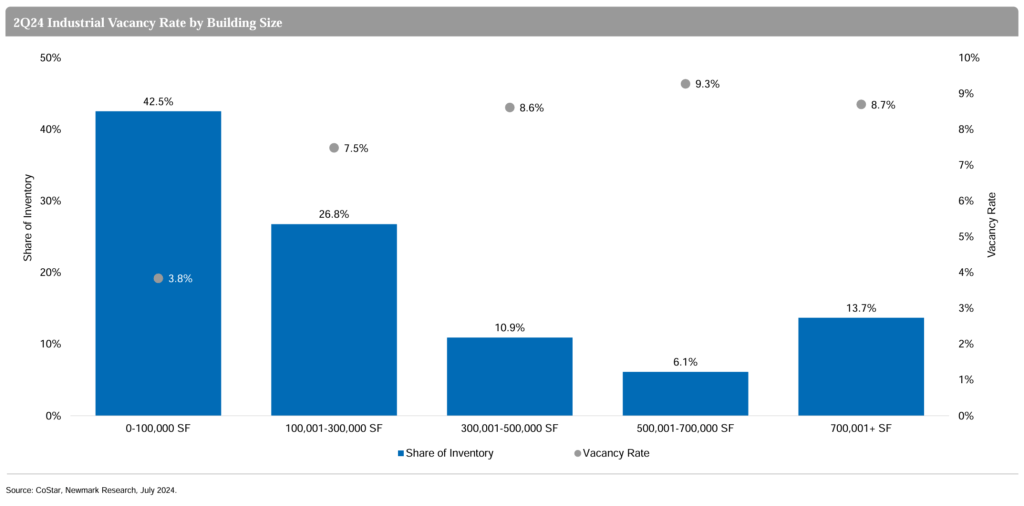

Industrial properties under 100,000 SF continue to lease strongly, with a vacancy rate of only 3.8% nationwide. The 4th tranche of properties (500,001-700,000 SF) has the highest vacancy rate, which currently sits at 9.3%.

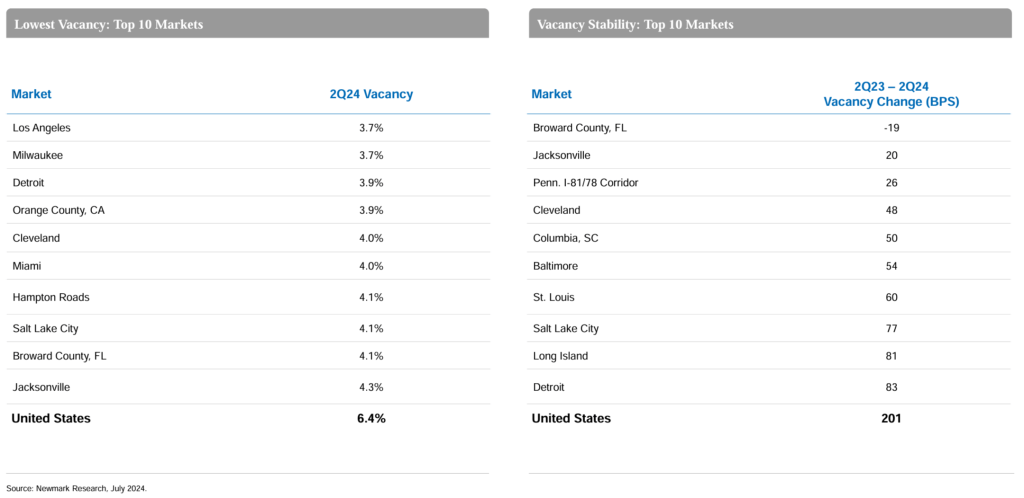

Cleveland remains one of the steadiest industrial real estate markets in the entire country. As of Q2 2024, Cleveland had a 4% vacancy rate in the industrial sector, outperforming several strong Florida markets.

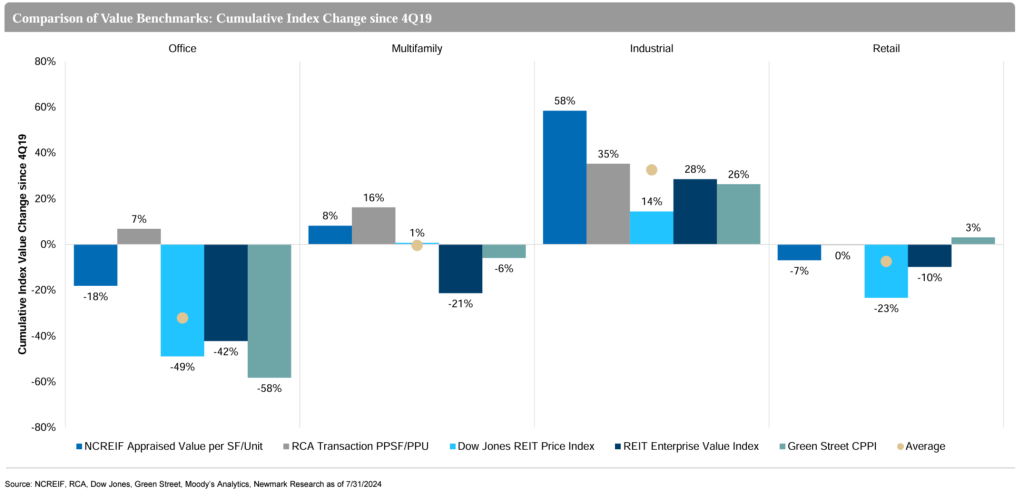

Since 2019, industrial real estate has been the best performing sector in commercial real estate in terms of value appreciation. There are a number of tailwinds that may allow industrial real estate values to continue to grow in the coming years.

Link to Newmark’s entire market report is here.

Sources: Newmark Research, US Bureau of Labor Statistics, FRED, Dow Jones, Moody’s Analytics, CoStar

Leave a comment