Overview

Cleveland’s industrial real estate market continued to steadily march along as the year progressed into late spring and early summer. There were many positive indicators displaying the strength and consistency of the market, however overall leasing activity slowed somewhat significantly compared to prior quarters.

Net Absorption and Vacancy Rates

In the second quarter of 2024, Cleveland’s industrial real estate market experienced positive net absorption as recorded by many large brokerage shops. Newmark reported 880K square feet of positive net absorption, CBRE reported 758K square feet of positive net absorption, and Colliers reported 716K square feet of positive net absorption. The vacancy rate remained steady at roughly 3% regionally, according to both CBRE (2.9%) and Colliers (3.1%). JLL reported a slightly higher vacancy rate of 3.5% for the quarter, while Newmark reported a 4.0% vacancy rate, which was a decrease of 30 basis points from their Q1 2024 vacancy rate of 4.3%.

Leasing Activity

The big theme of the quarter was a decline in leasing activity across Cleveland and Northeast Ohio. CBRE reported leasing activity of only ~500K square feet in Q2 2024, a significant drop from the 1.7M square feet in Q1 2024. According to Colliers, leasing activity totaled roughly 794K square feet. Newmark reported 880K square feet of leasing activity, about half of what it was in Q1 2024 (1.6M SF). Industry experts/brokers believe the leasing activity will continue at this new baseline for the reminder of the year and activity will remain relatively steady.

Lease Rates

In Cleveland, CBRE reported that the average asking lease rates for Warehouse, Flex and Manufacturing properties were $5.41/SF, $8.31/SF, and $5.48/SF, respectively, which was in line with the prior quarter. According to Colliers, across Cleveland and Akron, the average asking lease rates for Warehouse, Flex and Manufacturing properties were $5.40/SF, $8.00/SF, and $3.62/SF, respectively. Asking lease rates across all industrial property types averaged $5.51/SF in Q2 2024, according to JLL, which is a slight increase from Q1 2024. Newmark reported an average asking lease rate of $6.22/SF for the quarter, which is the highest ever for the Cleveland industrial market and broke the record set in the previous quarter at $6.21/SF.

Construction Pipeline

There is currently 2.4M SF of industrial space currently under construction across Northeast Ohio, according to Colliers. CBRE says the market still has over 1.1M SF of industrial product still under construction. Lee & Associated reported 2.2M SF of industrial space is currently under construction (0.6% of inventory), while Newmark reported roughly 1.2M SF of industrial product is currently under construction, which makes up just 0.4% of the overall inventory. Inflation, labor costs and financing challenges are all contributing factors leading to a slowdown in construction activity nationally and regionally. One major construction completion in the quarter was a 255K SF facility for LG Chem in Ravenna.

Notable Transactions

There were several notable transactions that occurred in Q2 2024:

- Royal Oak Realty Trust purchased Riddell Sports Group’s facility in North Ridgeville (7501 Performance Lane) for $36.5M (or $105.13/SF)

- Diamond Properties bought a 151K SF industrial property in Solon (30500 Bruce Industrial Pky) for $9.75M ($64.57/SF)

- The Macomb Group bought a 324K SF facility in Willoughby (4505-4665 Beidler Road) for $4.5M ($13.89/SF)

- JendEx Services, a logistics company, leased 100K SF of space at 3960 Summit Road in Barberton

- D&S Inc signed a 150K SF lease at 6200 Riverside Dr (IX Center)

Economic Commentary

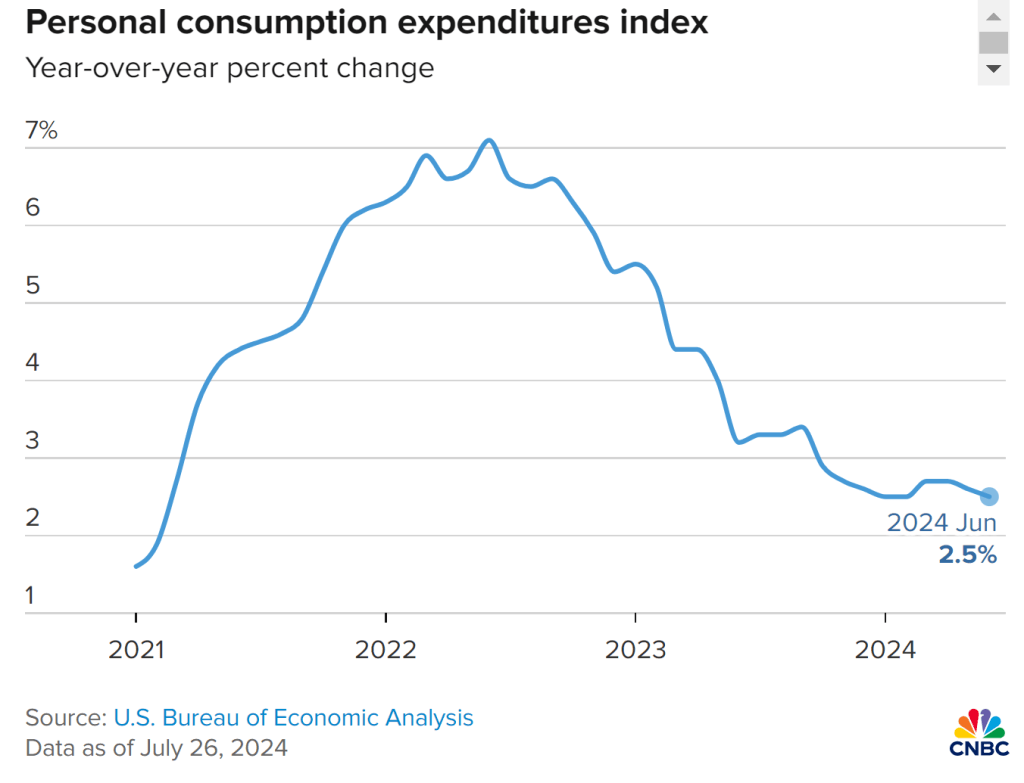

The personal consumption expenditures price index increased 0.1% in June as compared to May, and increased 2.5% YoY, which was in line with analyst estimates. For context, the YoY change in the index in May was 2.6%. Inflation is still rising, but the rate of increase appears to be slowing, which is a welcome sign for real estate investors, developers and brokers. The Fed has their next Federal Open Market Committee on July 30 and 31, and analysts expect no rate cuts to occur. However, markets are pointing to a rate cut at the Fed’s meeting in September, which would be the first reduction since the beginning of the pandemic.

As of May 2024, the US unemployment rate was 4%, in-line with the Greater Cleveland metropolitan unemployment rate. However, for the second quarter in a row, Cleveland’s Manufacturing sector saw a 1.2% YoY decline in employment. Cleveland’s Construction sector saw a 0.8% YoY growth in employment during the same period. Year over year growth in the Trade, Transportation and Utilities sector was 0.5%. Across the region, the Education & Health sector experienced the highest YoY employment growth, reaching 3.3%. Cleveland’s manufacturing sector employs roughly 118K people.

Outlook

Cleveland’s industrial real estate market is positioned for continued stability during the second half of 2024. Vacancy rates, rent growth and absorption rates all prove that the market is performing well, albeit at a slower pace than prior years. Vacancy rates are expected to remain steady, while construction of new industrial facilities will remain below normal levels. All eyes are on the Federal Reserve and their ability to tame inflation. Whenever rates come down, more investment activity is likely to occur in Cleveland and across the country.

Sources: Newmark, Lee & Associates, JLL, Colliers, CBRE, CNBC, US Bureau of Labor Statistics

Leave a comment